What you need to know about Inheriting a house that is paid off in Oklahoma City

Inheriting a house can be a blessing and a curse sometimes. If the house needs repairs, who is going to make them and pay for them? Are you going to rent it out? Do you want to be a landlord? What about hazard insurance? What if someone breaks in?

Inheriting a house can be a blessing and a curse sometimes. If the house needs repairs, who is going to make them and pay for them? Are you going to rent it out? Do you want to be a landlord? What about hazard insurance? What if someone breaks in?

There are plenty of things to worry about for sure. However, there are also many positives to inheriting a house that is paid off in Oklahoma City as well. For example…….you don’t have to worry about mortgage payments or foreclosure. You still have to pay taxes, utilities, and insurance but no mortgage is a huge benefit. You have plenty of equity, hopefully, to profit off the home. You also have more options on what you can do with a paid off home and how you can sell it versus a home with a mortgage against it.

As a company that buys many houses in every month, we have dealt with many, many folks that inherited houses and helped them either sell it or figure out what to do. Below are a few things you need to know about inheriting a house that is paid off in Oklahoma City from our own knowledge and experiences of others we’ve worked with…

Tip #1 – Leverage your equity with a bank

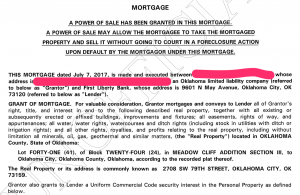

If the house is paid off, a bank will give you a loan against some of your equity in the house. If you need some quick cash with a low interest rate, this is an option you should consider. The bank will typically lend up to 60-80% of the value of the home. Remember that with a mortgage, comes monthly payments. If you cannot afford the payments or fall behind, you will lose the house and have a foreclosure against your name.

Keep in mind the bank will get an appraisal on the house and it needs to be in at least decent condition to get such a loan. A bank typically won’t lend money against a house that is falling apart or not livable. Sometimes you can get a special loan to help repair the house with money from a bank. If you need some advice on local lenders to use in OKC, please call or text us at 405-673-4901 or e-mail at Tyler@WPropertiesOK.com.

Tip #2 – Sell your house for 2x what it is worth

Most people don’t know that there are more ways than one to sell a house, especially if it is paid off. Unfortunately, 99% of homeowners only know ONE way to sell a house – hire a real estate agent, repair/clean the house or update as needed, let it sit on the market until a buyer comes along, then you sell the house and get a big check at closing.

Most people don’t know that there are more ways than one to sell a house, especially if it is paid off. Unfortunately, 99% of homeowners only know ONE way to sell a house – hire a real estate agent, repair/clean the house or update as needed, let it sit on the market until a buyer comes along, then you sell the house and get a big check at closing.

There is another way though….. You can end up making 2x what the house is worth in the end. It’s called owner financing. It’s been around for decades and works like this: you want to sell a house….you find a buyer (like us at W Properties)…..instead of the buyer getting a loan from the bank you agree on a price you want and the buyer pays you this amount monthly over time with interest. Just like a bank, you are guaranteed the buyer will pay by placing a lien against the house. If they don’t pay, you take it back. In the end, if you sell a house for $100,000 this way, you can collect an extra $552 dollars per month for 30 years and net $198,000 in the end.

If you are inheriting a house that is paid off, you should also consider the tax consequences of selling that property. The IRS will want their piece of the pie in some instances. You can read more about IRS guidelines on selling inherited property here.

Tip #3 – Keep insurance on the house

This one is simple. We can’t be clear enough though. Whether you are living in the house or renting it out or it is empty….keep. insurance. on. the. house.

This one is simple. We can’t be clear enough though. Whether you are living in the house or renting it out or it is empty….keep. insurance. on. the. house.

Too many times have we seen people inherit a home and try to save money by canceling the insurance policy on the home. So many things can go wrong from the house catching fire, tornado damage (this is Oklahoma after all), wind damage, hail damage, vandalism (especially if house is vacant). The list goes on and on. Don’t risk your inherited home to save $50 – $200 a month. It just isn’t worth it.

While we are talking about insurance, don’t forget to keep the right policy in place. If the house is empty, tell your insurance provider. If the main policy holder is deceased, tell the insurance provider. Nothing is worse than paying for insurance and not being able to file a claim due to some technicality in the fine print.

Tip #4 – Renting isn’t as bad as it seems

A good long-term choice is to rent the house out. It’s a great investment and form of retirement. The key is to know your costs. If you rent a house for $1,000 a month, you don’t make $1,000 a month. Vacancy will cost you 5-10% of your monthly rents each month over the years. Repairs will cost you 10-12% of your rents each month over the years. Imagine if the AC unit goes out, that is $3,000 – $6,000 to fix. You have to factor in taxes and insurance also. If you have someone manage the property that will cost you another 8-10% of your monthly rent. As you can see, $1,000 rent doesn’t mean $1,000 in your pocket every month.

A good long-term choice is to rent the house out. It’s a great investment and form of retirement. The key is to know your costs. If you rent a house for $1,000 a month, you don’t make $1,000 a month. Vacancy will cost you 5-10% of your monthly rents each month over the years. Repairs will cost you 10-12% of your rents each month over the years. Imagine if the AC unit goes out, that is $3,000 – $6,000 to fix. You have to factor in taxes and insurance also. If you have someone manage the property that will cost you another 8-10% of your monthly rent. As you can see, $1,000 rent doesn’t mean $1,000 in your pocket every month.

A good property management company can handle everything on your rental from finding a tenant to collecting rent and making repairs. Just be aware that no one will ever manage a rental property better than the person that owns it. If you need some tips on a few good property management companies in OKC, just call/text us at 405-673-4901.

Tip #5 – Sell it the EASY way

Our company buys houses all the time. We make it EASY to sell one by paying all closing costs and purchasing homes as-is with no repairs or cleaning required. This means you can inherit a house that needs lots of repairs and is full of junk and turn it into cash. We buy many houses that need work but also nicer ones also. If your home doesn’t need any work, we’ll still buy it and save you the hassle of cleaning, paying a real estate agent plus closing costs, and dealing with traditional buyers.

Hopefully these tips helped you if you are inheriting a house that is paid off in Oklahoma City. We’ve worked with many people in this same situation and are ready to help you if needed. If you are ready to sell a home you are inheriting or just have questions, call or text us at (405) 673-4901.

If the house you inherited has a mortgage, you can find more about inheriting a property WITH a mortgage here.

You can also fill out the form below and we’ll be in touch with you in 24 hours.

Ready to sell your house the EASY way?

The EASY way to sell a house is.....You get paid exactly the price we agree on. You pay $0 in repairs, $0 in closing costs, $0 in commissions. No cleaning/repairs required. Close and get paid on date of your choice

Fill out the form below and tell us about your property to get an offer today!